Energy Transfer, Sunoco Announce Strategic Permian Basin Crude Oil Joint Venture

Energy Transfer LP (“Energy Transfer”) and Sunoco LP (“Sunoco”) have announced the formation of a joint venture combining their respective crude oil and produced water gathering assets in the Permian Basin.

Energy Transfer will serve as the operator of the joint venture and contribute its Permian crude oil and produced water gathering assets and operations. Sunoco will contribute all of its Permian crude oil gathering assets and operations to the joint venture. Energy Transfer’s long-haul crude pipeline network that provides transportation of crude oil out of the Permian Basin to Nederland, Houston, and Cushing is excluded from the joint venture.

Energy Transfer will serve as the operator of the joint venture and contribute its Permian crude oil and produced water gathering assets and operations. Sunoco will contribute all of its Permian crude oil gathering assets and operations to the joint venture. Energy Transfer’s long-haul crude pipeline network that provides transportation of crude oil out of the Permian Basin to Nederland, Houston, and Cushing is excluded from the joint venture.

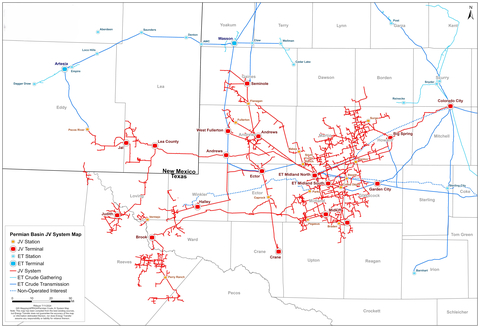

As depicted in the included map, the joint venture will operate more than 5,000 miles of crude oil and water gathering pipelines with crude oil storage capacity in excess of 11 million barrels.

Energy Transfer will hold a 67.5% interest in the joint venture with Sunoco holding a 32.5% interest.

The formation of the joint venture has an effective date of July 1, 2024, and is expected to be immediately accretive to distributable cash flow per LP unit for both Energy Transfer and Sunoco.

Intrepid Partners, LLC served as financial advisor to Energy Transfer’s conflicts committee, while Guggenheim Securities, LLC served as financial advisor to Sunoco’s special committee. Potter Anderson & Corroon LLP acted as Delaware counsel for Energy Transfer’s conflicts committee, and Richards, Layton & Finger, P.A. acted as Delaware counsel for Sunoco’s special committee. Vinson & Elkins LLP and Akin Gump Strauss Hauer & Feld LLP also acted as legal counsel to the partnerships on the transaction.