Maritime Fuel Market Fraud Could Be Costing $5 Billion Each Year

Common practices in the $245 billion maritime fuel market (“bunker fuel”) could be causing significant financial losses. Trusted technology to enable better transparency could be the means of making transactions more cost-efficient.

Fraud in the maritime industry is not new. As far back as 300 BC, when a Greek sea merchant intentionally committed insurance fraud, stories of unethical practices on the high seas have been shared. Today, it can be harder to prove fraud than in the past. However, as evidenced by a large number of fuel contamination incidents and bunker fraud arrests globally, it’s still an ongoing issue. While off-spec bunker fuel claims represent only about 3% of total machinery claims, even “on-spec” bunkers have a significant amount of fuel volume or content issues, leading to financial loss or engine issues. Last year alone, over 600 vessels were disabled through to “on-spec” fuels, and the financial losses from under-deliveries or adulteration are estimated in excess of $5 billion globally.

Studies from the Protection and Indemnity (P&I) clubs indicate that 42% of claims are categorized as “machinery”, of which 16% are due to main engine damage caused by off-spec bunkers, which cost $545,000 on average to repair.

Studies from the Protection and Indemnity (P&I) clubs indicate that 42% of claims are categorized as “machinery”, of which 16% are due to main engine damage caused by off-spec bunkers, which cost $545,000 on average to repair.

These machinery claims do not include catastrophic claims due to loss of propulsion, most often tied to fuels or long-term damage from fuels. Such catastrophic claims can be in the millions, to hundreds of millions per incident. The fuel contagion incidents in Asia, the ARA zone, and the Fujairah regions last year are estimated to have cost nearly $50 Million in towing fees alone.

Assessments by FuelTrust, a Houston based Artificial Intelligence startup focus on the Energy Supply Chain, indicated that between 2019 and 2022, over 39% of all bunkers globally had a 2% or greater delta of fuel content and amounts delivered from their delivery paperwork. The most common issue found was water introduction to fuels in the journey from their land-based storage tank to the ship bunker tank. This indication, typically seen as a 0.1% water being increased to 0.29% water – kept under the regulated threshold, but still resulting in average losses of $14,910 per impacted delivery.

Of note, the introduction of electronic mass flow meters has been helpful in reducing “paper fraud” and collusion. The need to go paperless and provide real time transactional reporting is still needed, and the industry is working toward viable solutions toward it. However, as transitional and future-fuels are being introduced into the market, a new wave of potential loss points are arising.

Operating heavy machinery in the middle of the ocean is risky under the most trustworthy conditions. When the potential of contamination, instability of fuels, and fuel incompatible mixtures, whether intentional or not, is introduced, exponential risk is created. The only viable way for the maritime industry to safely embrace new fuels and more efficient fuel supply channels is through shared-party transparency, with decisions backed by data from partners who are empowered to mutually trust each other.

Top Spots for Fraud Opportunities

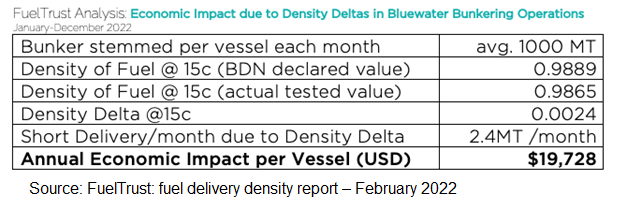

Fuel Density Inaccuracy

Misstating fuel density at time of delivery is one example of a fraud opportunity. Marine fuel is sold by weight (mass) and delivered by volume. If the density on the Bunker Delivery Note (“BDN”) is inaccurate – the volume received reflects a higher quantity than the actual weight delivered – then the short-delivered quantity results in a commercial loss. Studies

have shown that 66% of Very-low Sulfur Fuel Oil(“VLSFO”) samples analyzed had a lower density declared on the BDN than the actual lab-tested density of the fuel. This is a typical indicator of “short bunkering”.

It’s important to understand that not all density discrepancies are due to intended fraud. They could result naturally from unintentional contamination that impacts the density. At present, industry lacks the capability to see patterns of contamination and the means to predict the risks associated with density discrepancies.

In an analysis of over 18 Million metric tons of bunker fuels in 2022, it was estimated the cost of short bunkering is over $2.95B billion annually, based on roughly 128,000 vessels in the global fleet.

Less easily calculated is the impact of the industry practice of excluding fuel quantity discrepancies of less than 3%. For example, a 3% difference on a single 1000MT fuel delivery, or approximately 30MT, would likely not be disputed, allowing a $15,700 loss to be considered acceptable. This discrepancy is different than the density issue, as it involves volume loss. Assuming a global fleet of 60,000 blue water vessels, estimates indicate over $209M per month in undisputed losses. This practice means that suppliers could be losing revenues, and/or their customers could be paying for product not received.

Temperature to Volume Relationship

Much like the issues seen with density inaccuracies, another common area for malpractice exists in the temperature to volume relationship. All petroleum products have a high rate of thermal expansion which should be considered when significant quantities are delivered. If a fuel delivery agent understates the temperature during the opening gauge and then overstates the temperature at the closing gauge, a volume discrepancy could easily occur.

Water in Fuel

Water in fuel isn’t uncommon from sources such as tank condensation. However, as indicated from real-world analysis, deliberate injection of water impacts the quantity and the quality of the fuel. Unfortunately, the exact proportion of water in the fuel is difficult to determine upon delivery – it’s only after settling that a true measurement can be determined.

Costs related to high water content aren’t limited to the loss of true fuel but may also include disposal costs of water separated from the fuel by the vessel’s oily water separator (“OWS”), a cost which increasing in ports around the globe.

Bunker Fuels

Bunker fuels are inherently “dirty”, even in their most pristine condition. These fuels need distillates and additives (“cutter stocks”) to reduce their viscosity enough to function in ship engines. Imagine the thin line between acceptable enhancements that improve their quality, and contaminants that can catastrophically damage a ship’s engine.

Everything from used motor oil, restaurant vegetable oil and rubber by-products have been found in “bad bunkers” - none of which should be part of a reliable fuel supply chain. Blue water ships have been known as the “incinerators of the refining industry,” but they should not become literal incinerators that contaminate the global environment as a result of fraudulent acts. As found in incidents that affected the ports of Singapore and Houston in 2022, the disposal of organic chloride oils by an unknown party into a bunker batch resulted in hundreds of disabled ships and a short-stock of replacement engine parts that affected global shipping for months.

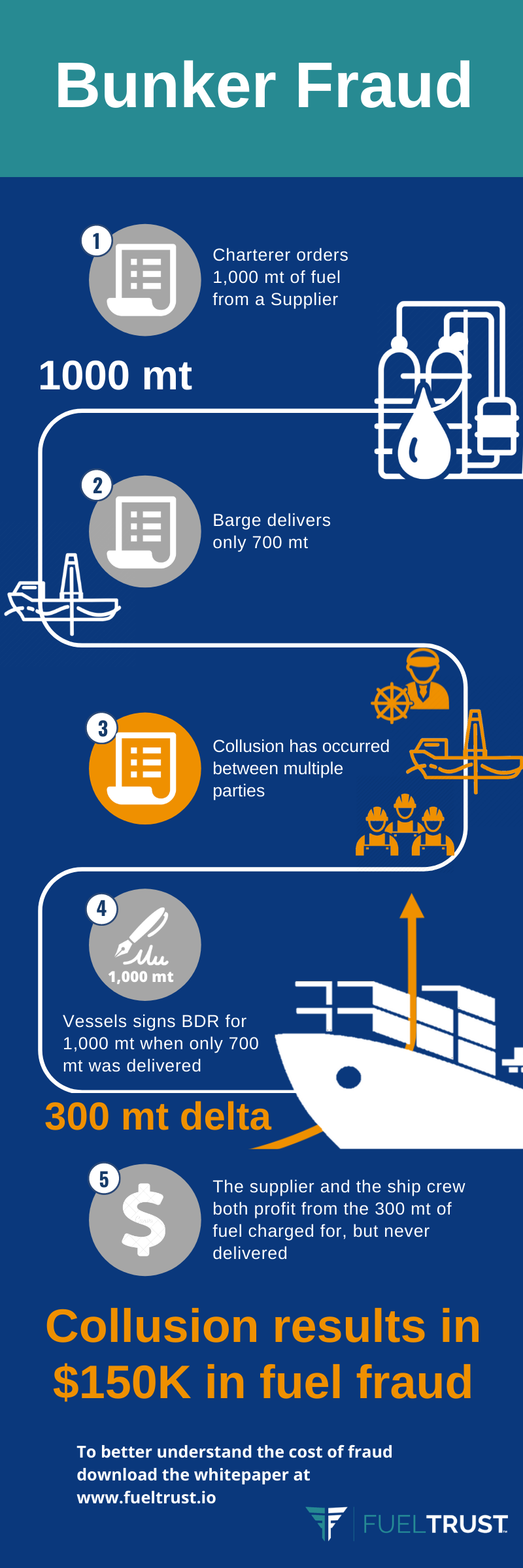

Intentional Collusion

The least technical form of bunker fraud is delivering less fuel than purchased through collusion between the supplier or barge crew and the ship crew. In such a case, the buyer orders 1000MT of fuel but only receives 700MT. The ship crew signs the BDN to reflect the full receipt of 1000MT. The buyer then pays the supplier for a full delivery with the value of the 300MT delta ($165,000 at an average $550/MT) being split between the colluders. The ship crew then covers the shortage by recording greater bunker consumption than what took place over the month of voyages reported.

Practices like this could involve an owner defrauding a charterer, the ship crew defrauding their owner, a charterer’s bunker buyer defrauding the charterer, or some combination of these scenarios. The best way to avoid this type of collusion fraud is to use reputable third-party bunker surveyors, along with regular voyage performance monitoring. Because this requires more expense, new hardware, and work, it’s often bypassed by those less than diligent or vigilant. Certain port authorities now regularly impose random surveys, or compulsory surveys on parties with found fraud in the past.

To further complicate fraudulent matters, should an owner have a dispute with a charterer over the fuels provided to the vessel, either in quantity or quality, they have a limited window of time in which they can lodge their protest and several obstacles to overcome to secure resolution.

BIMCO, an international shipping association which sets the basis for most fuel purchase/sale contracts, provides buyer and seller with 14 days to file a quantity claim and 30 days to file a quality claim. The onus of responsible investigation places a tremendous amount of pressure on owners and suppliers that oftentimes may be unachievable under the best of conditions with current technology or manual methods. Even when BIMCO updated their widely accepted Standard Fuel Sulfur Content Clause for Time Charterers in response to the MARPOL air quality regulations which came into effect in May 2019 the time span limits remained, and the need for the affected party to produce a responsible set of evidence and investigation in such short order often leads to an “acceptable losses” decision, and therefore no notification to regulators, insurers, or other third parties – washing the losses into an opaque market model, but affecting the bottom line of the supplier, the charterer, and the shippers.

Creating A Trusted Fuel Ecosystem Through Transparency and Traceability

While fuel supply chain issues remain across the industry, and particularly in maritime fuels, hope is not lost. Fuel Suppliers are making efforts to gain visibility to the end-delivery outcomes of their products, and fuel buyers are beginning to leverage advanced technologies to reduce fraud and losses while at the same time decreasing their environmental risk exposures.

FuelTrust has created an AI-based approach to assessing and validating the fuel supply chain, creating a digital DNA of every batch of fuel and its chemical content. Fuel volumes, quality, and emissions potentials are assessed at every step of the delivery chain, including post-combustion. This data, including fraud and risk alerts, are privately shared through its patented blockchain-enabled products.

By “fueling trust” through its secure cross-party platform, FuelTrust provides fuel suppliers, shipowners, charterers, and regulators with the information needed to make better decisions, accurately report emissions, and to reduce potential fuel contamination, collusion, and commercial losses.