Port Houston Update

January 2024 Commerce Club Featuring Roger Guenther, Executive Director, Port Houston

Roger Guenther, executive director of Port Houston, presented the latest changes and what’s new at Port Houston at the Port Bureau’s Commerce Club luncheon on Jan.11. The event was hosted at the Houston Marriott South.

Roger Guenther, executive director of Port Houston, presented the latest changes and what’s new at Port Houston at the Port Bureau’s Commerce Club luncheon on Jan.11. The event was hosted at the Houston Marriott South.

Created over 100 years ago as the Harris County Navigation District, Port Houston manages eight public terminals, including operating Barbours Cut and Bayport container facilities. As the advocate and a strategic leader of the Houston Ship Channel, Port Houston supports the more than 200 facilities and the neighboring communities along it by working with the federal government.

What Has Changed?

Results from the latest economic impact study showed that the Houston Ship Channel generated $906 billion of economic value to the U.S. in 2022, representing a 13% increase since the previous study in 2018. This represents:

- -1.54 million jobs in Texas

-3.37 million jobs nationwide

-$439 billion economic impact in Texas

-$906 billion economic impact across the U.S.

“Another big change,” said Guenther, “is Port Houston has leaped from being the #7 container terminal in the country to being the #5 container terminal.”

Showing graphs for loaded imports and exports for the timer period of 2023 (YTD October) vs 2022, Guenther noted that while loaded imports has slowed, Houston’s decrease was significantly less than either the West Coast, East Coast, or the total U.S.

In looking at exports, Guenther noted that while the West and East Coasts were down, the U.S. as a whole is up slightly. Houston, however, showed an increase of 11%. “Exports continue to pour through our docks! …. We lead the nation … About 60% of polyethylene resins that are produced in our country are exported through the port of Houston,” said Guenther.

Guenther said previous pandemic-related supply chain challenges are essentially gone. Operations are normal but Port Houston handles 30% more cargo than three years ago. Port Houston continues to add capacity, with more docks, big cranes, and addition RTGs. The infrastructure investments continues in order to keep ahead of the demand curve.

What’s New?

New potential impacts to port operations in 2024 include drought conditions at the Panama Canal and tensions at the Suez Canal. Guenther said 50% of import cargo comes via the Panama Canal. While current transit limitations at the Panama Canal have not affected volume, it is unknown what pressures delays could cause. Thirty percent of world trade goes through the Suez Canal. As threats to ships transiting the Suez continue, costs rise and uncertainty increases for everyone.

Project 11 – Where We Are

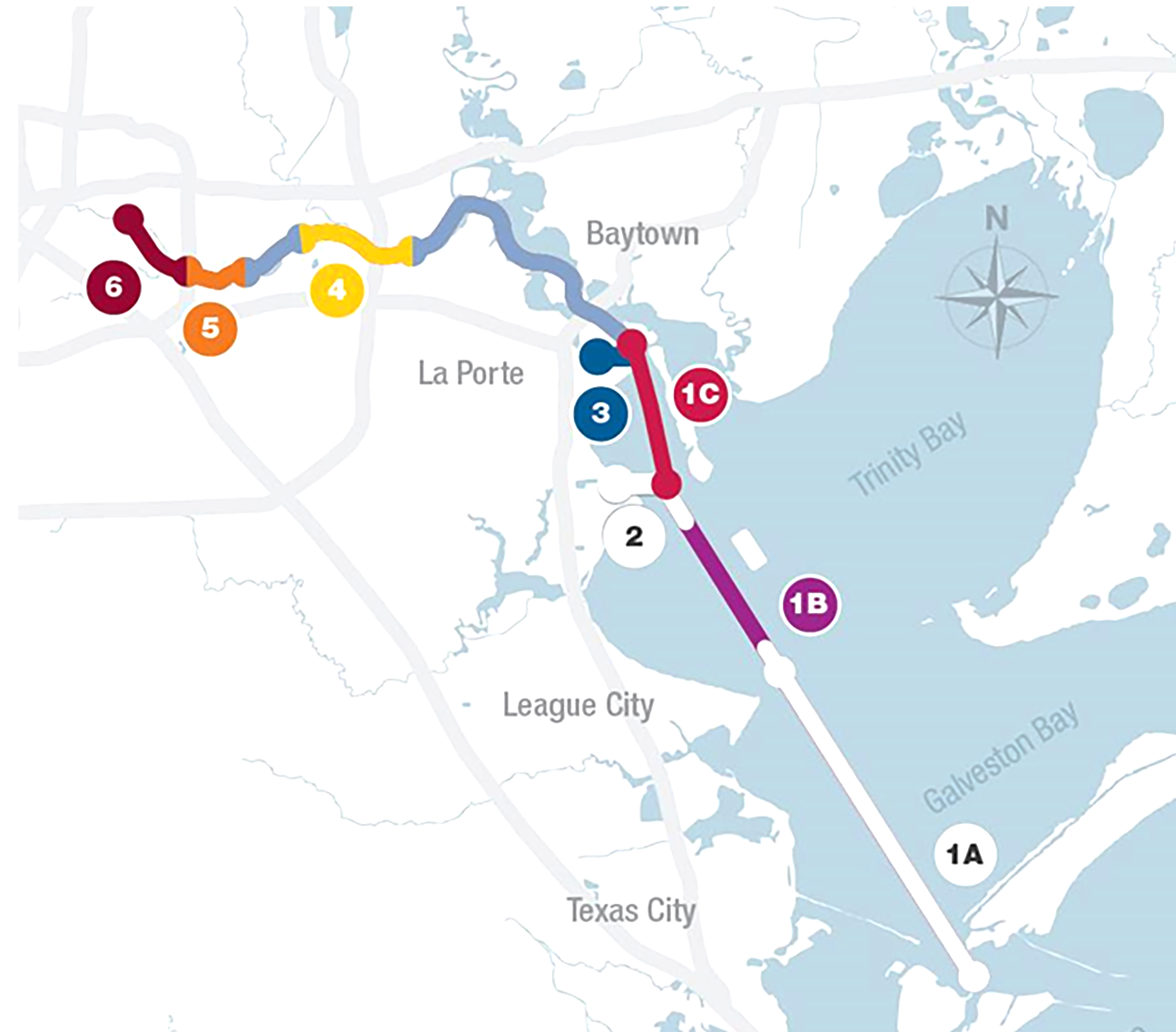

Looking at Project 11 – the widening and deepening of the Houston Ship Channel – Segment 1A (Bolivar to Redfish) were completed in quarter one 2023 and Segment 2 (Bayport Ship Channel) were completed in quarter four 2023. “Hopefully by the end of this year, we will have completed more than 27 miles of Galveston Bay and all segments for a wider channel for everyone,” said Guenther.

Looking at Project 11 – the widening and deepening of the Houston Ship Channel – Segment 1A (Bolivar to Redfish) were completed in quarter one 2023 and Segment 2 (Bayport Ship Channel) were completed in quarter four 2023. “Hopefully by the end of this year, we will have completed more than 27 miles of Galveston Bay and all segments for a wider channel for everyone,” said Guenther.

The non-federal contribution for completion of the full project is $825 million. The Port of Houston Authority has incurred that project debt through the sale of revenue bonds, making regaining the costs essential. Guenther indicated that a structure for a user fee for recapturing costs can only be implemented when “an incremental part” of the project is completed. This is estimated to be in late 2025.

“We want it to be fair and equitable to all users,” said Guenther, noting meetings and hearings with the port commission are planned. “We have a year to work on the process.”

Guenther also discussed sustainability, freight mobility – and the need for greater efficiency in transporting cargo away from the terminal, additional terminal improvements, and the move of the administration building to the historic East River development area on Buffalo Bayou downtown.

Thank you to our Commerce Club sponsors:

Annual Table sponsors:

Callan Marine • Enterprise Products Partners • Kinder Morgan • Houston Pilots • Intercontinental Terminals Company • Moran Shipping Agencies, Inc. • Pemex • Shell • Targa Resources • TGS Ceder Port Industrial Park • WGMA

January Table sponsors:

BWC Terminals • Campbell Transportation Co. • Excargo • Houston Mooring Company • Lockwood, Andrews & Newman, Inc. • PlainsCapital Bank • Odfjell • Port Houston • Schröder Marine Services, Inc. • Vopak